Alternative payments are becoming an increasingly important component of ecommerce.

According to Worldpay’s 2017 Global Payments Report, more than half of all online transactions will be made through alternative payment methods by 2021. This change is being driven by many factors, such as the growth in global ecommerce, the need for better payments security, and the evolution of social media.

As with any other technological sea change, the players who figure out how to leverage the new technologies first will have a sizeable edge over late adopters. In this article, we take a look at a few of the most exciting methods of alternative payments available today, and how ecommerce retailers can take advantage of them.

E-Wallets

E-wallets such as Apple and Google Pay allow online shoppers to store their credit card and bank info within a secure app, then make payments directly through that app. While adoption rates for e-wallets have fallen short of expectations thus far, they are still steadily growing in popularity, and there are powerful reasons why that’s happening.

For one, e-wallets can be very convenient, and are often the fastest way to complete an online checkout. A recent study by the Baymard Institute found that 27% of customers abandon carts because the checkout process was too long or complicated. This is especially true for mobile users, since filling out forms on a touchscreen can be a painfully inefficient process. An e-wallet lets customers skip entry of billing, shipping and payment information, greatly improving the chances of a successful checkout.

For another, e-wallets are a lot more secure than traditional checkouts. In the same Baymard study, 18% of customers abandoned their carts because they decided they did not trust the site with their credit card information. Most major e-wallets use encryption technology and other security tools to protect payment information, and can act as a defensive proxy between the ecommerce site and the customer’s financial accounts. This can give customers the peace of mind they need to complete their purchase.

To start accepting e-wallet payments on your own site, check with your payment provider to see if their gateway is compatible with e-wallet technology.

Chatbots

Ecommerce chatbots are another technology set to revolutionize ecommerce payments. These are programs designed to assist customers in a specific way, such as by offering product recommendations or answering common questions.

While some might dismiss chatbots as a fad, most online retailers disagree. A recent Oracle survey found that 80% of businesses either already use chatbots or are planning to implement them by 2020. And Grand View Research predicts that the international chatbot market will reach $1.23 billion by 2025.

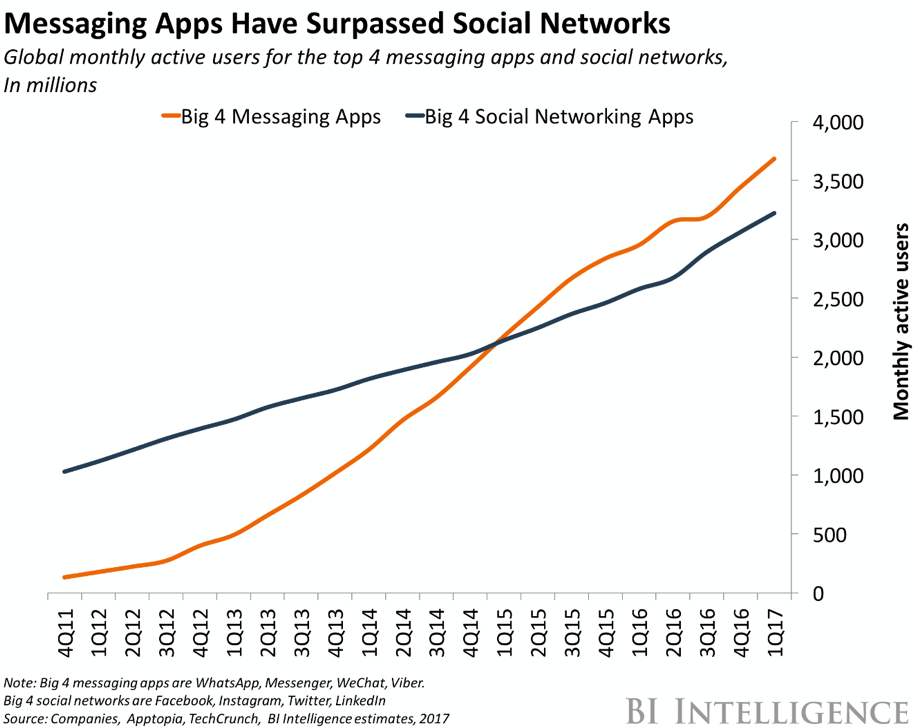

One key driver of this trend is the increasing popularity of messenger apps. In fact, Business Insider found that consumers have been using messenger apps more frequently than social networks since 2015:

Source: https://www.businessinsider.com/the-messaging-app-report-2015-11

This means that chatbots hosted on the major messaging platforms can reach consumers where they are already spending time online.

The other major reason is that chatbots can significantly improve the customer experience in several ways, such as:

- Making relevant product suggestions and upsells based on the customer’s shopping history

- Providing personalized help for each customer’s unique inquiries and support needs

- Being available for customers around the globe, 24 hours a day, 7 days a week

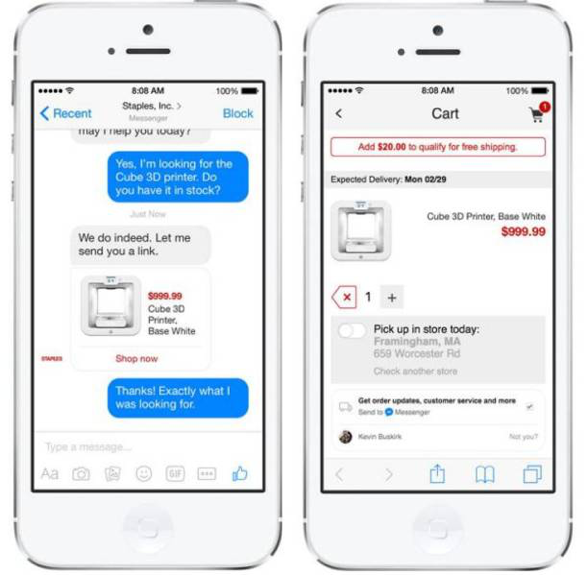

A great example of this Staples’ Facebook messenger chatbot, which is able to help customers with basic queries, identify products they’re looking for, and even allow them to complete their purchase directly through the messenger interface.

Source: https://www.cash.at/typo3temp/pics/dd1f78286f.jpeg

The best part is that these chatbots are quite simple to set up, since messaging platform providers are incentivized to make the process as easy as possible. Facebook’s Messenger Platform is a good place to start. Kik is another popular chatbot platform with over 15 million monthly users, while Chatfuel is a great option for non-technical entrepreneurs.

Blockchain Currencies

Bitcoin and other blockchain currencies are now in the mainstream consciousness. While the technology is still highly controversial, major online retailers like Overstock.com, Expedia and NewEgg have started to accept Bitcoin as a form of payment. There are a number of compelling reasons you might want to hop on board as well – especially if sell to a more tech-savvy customer base that won’t be intimidated by the technology.

First, bitcoin purchases are peer-to-peer transactions that don’t go through any financial intermediaries – which means no interchange fees and faster payments. Since there’s no waiting time for checks or credit card payments to be approved by a third-party, you can get your money the instant a customer clicks the “buy” button.

Second, bitcoin purchases can be made anonymously. From a customer standpoint, this can be very appealing because it means they don’t have to hand over their payment information or personal details. From the merchant’s perspective, this also eliminates the risk of fraud, as you have no need to store or protect confidential data.

Third, bitcoin payments are “push” transactions that are initiated by the purchaser, not the seller. Essentially, this makes chargebacks to the business impossible, because the customer bears responsibility for the transaction, and therefore cannot claim unauthorized charges.

Despite these attractive benefits, there is one major downside to accepting Bitcoin – its volatility. Bitcoin is still a niche currency with a small market cap, and its value can go up or down significantly in a matter of hours. To minimize this risk, you should ensure that Bitcoin transactions are converted to your local currency at the time of transaction, and that Bitcoin purchases don’t constitute an overly large portion of total sales.

While you can process Bitcoin transactions manually by signing up for a wallet and generating a unique Bitcoin address for each purchase on your site, we don’t recommend it. This route will require you to handle invoicing, billing and shipping on your own, and can get very complex as you scale your operations.

A much simpler solution is to use a payments provider that allows you to accept Bitcoin. These providers will typically allow you to connect your Bitcoin wallet to their platform, or even create a wallet through their system if you don’t already have one. For non-technical entrepreneurs, a full-service provider will often have a dedicated team to assist you with the implementation.

Embrace the Future

Alternative payments are going to become increasingly important in the ecommerce world over the next decade. By implementing these cutting-edge payment methods today, you’ll be able to secure a major headstart on your competitors, and provide customers with a much more compelling payments experience.