As new smart speaker competitors enter the market, expect them to find new ways to appeal to consumers. But the question remains on how this will impact voice commerce.

Facing More Competition

Voice assistants are gaining more popularity than ever, as a recent eMarketer report has revealed that Amazon Echo will lose some of its market share this year to the likes of Google and other new smart speaker players like Apple, Sonos and Facebook.

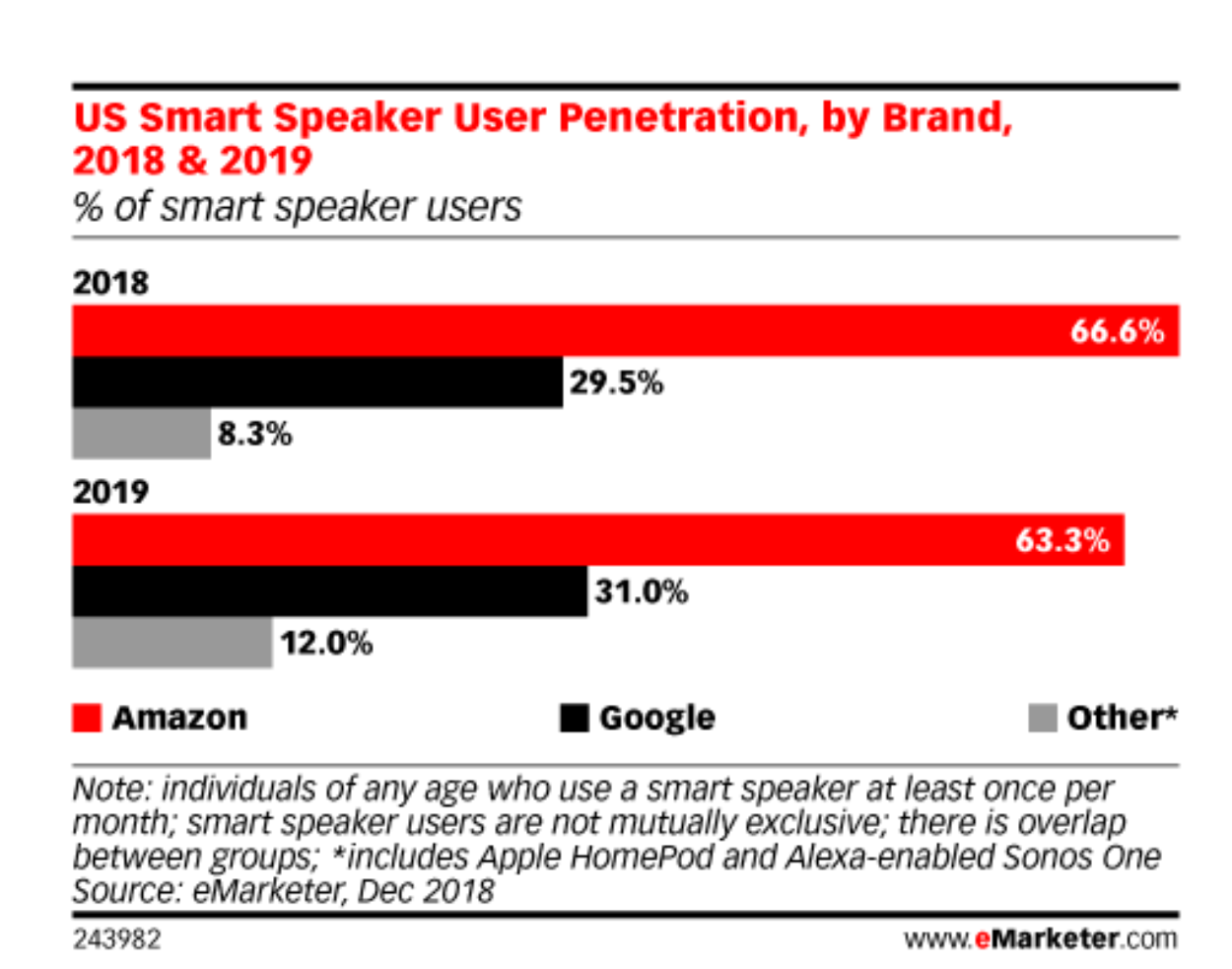

Image Source: eMarketer

Capturing a whopping two-thirds of the smart speaker market in 2018, Amazon Echo will likely drop below that threshold to 63.3% this year, while Google Home is forecasted to slowly creep forward from 29.5% in 2018 to 31% in 2019.

Even though Amazon still has a healthy hold on the majority of the smart speaker market, the decision by Sonos to soon allow its smart speaker to integrate with Google Assistant (which was previously exclusive to Amazon Alexa) will likely have a positive impact on both Sonos One purchases and Google Assistant adoption.

In addition to Sonos One going hybrid, both the Apple HomePod and Facebook Portal recently wrapped up their first holiday season, adding even more options and disruption to the smart speaker market than we’ve ever seen.

Rising Adoption Rates

The rise in new virtual assistants is a direct result of growing consumer demand. This year, smart speaker usage in the United States will increase 15% more than it did in 2018, with 74.2 million people hopping on the voice wagon. By the end of the year, over a quarter of US adults will use these smart speakers on a monthly basis.

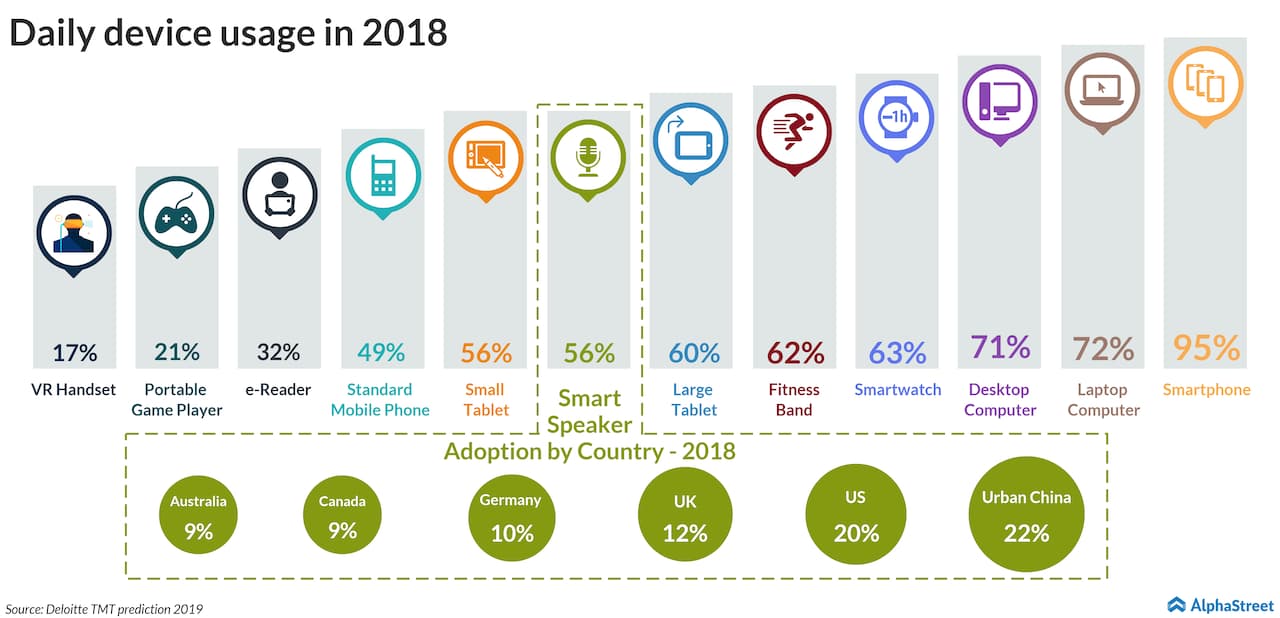

Stepping back and looking beyond the US, the smart speaker market as a whole is poised to grow even higher and is expected to jump by 63% as these devices become more commonplace in our everyday lives. Deloitte predicts that both Google and Amazon will sell over 164 million smart speakers this year globally, compared to roughly 98 million in 2018.

Image Source: AlphaStreet

Where Voice Commerce Stands

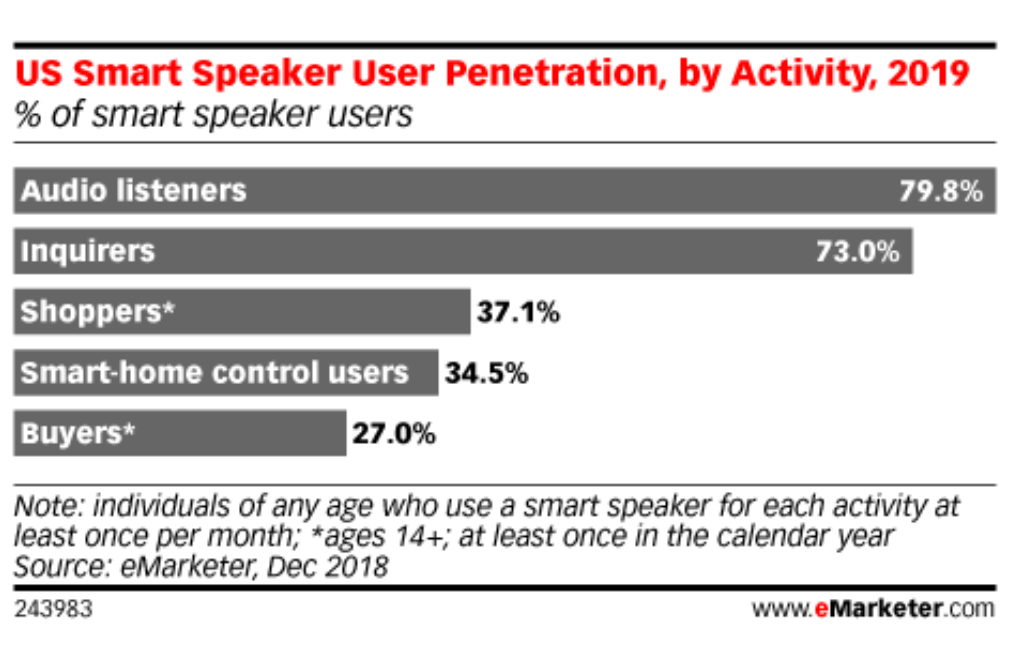

As for whether consumers are using their smart speakers to make purchases, there is still a lot of room for growth.

Voice commerce reached $2.10 billion last year, which is less than 1% of total US ecommerce revenue. In 2019, 27% of smart speaker owners will use their devices at least once to make a purchase, which is lower than a previous projection by eMarketer that expected that number to be over a third.

Image Source: eMarketer

As eMarketer principal analyst Victoria Petrock explains, “We still don’t see a lot of people shopping and buying with smart speakers yet, but this may change if more lower-cost models begin to incorporate screens. We’re also likely to see people doing more things with their voice assistants as they find their way into cars and other home-based devices.”

Looking Ahead

Increased competition is always great news for the consumer, as Amazon, Google, and all the other smart speaker brands will continue to battle it out to provide the best experience possible for users, but in terms of voice commerce specifically, it would seem that none of these brands have figured out the winning formula to really capitalize on the opportunity.

Having said that, the year has only just begun and as we learned in 2018, a lot can change very quickly when it comes to technology updates and adoption rates. One of the interesting components about this race to the top is that all of these products have a unique edge: Amazon’s direct connection to its shopping platform, Google’s ability to tap into its powerful search realm, Sonos being able to appeal to both Amazon and Google users, Apple’s integration with Siri and Apple Music, and Facebook introducing the smart display which – as mentioned in Petrock’s statement above – could be a bit of a game changer. However, with all the privacy concerns Facebook is engulfed in right now, shoppers may not feel too keen on adopting another Facebook product.

All of the players have a way they can leverage their strengths to get consumers to use their model. As for which brand makes the most significant strides this year to making it easier to connect the consumer with the product, we’ll just have to wait and see.